Starting a nonprofit? Here is how to categorize your organization

There are so many exciting facets of starting your own nonprofit: the thrill of helping people, the joy of making connections within your community, the whirlwind rush of throwing a fundraising event… the list goes on and on. However, we’re going to go ahead and assume your personal list doesn’t include red tape, taxes, or the IRS. It’s just a guess – correct us if you’re wild about audits!

There are several ways to categorize your organization, and it’s important to understand the details of each classification.

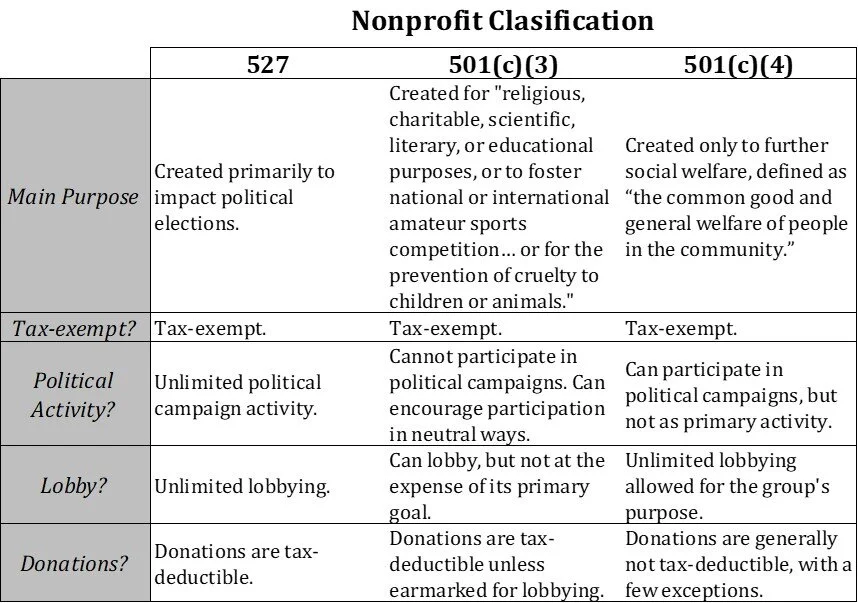

If your group exists to impact the nomination or election of a political candidate, it may be categorized as a 527 organization. A 527 group or organization is exempt from taxation under Section 527 of the United States Internal Revenue Code. Creative naming, right? These groups cannot advocate for any one campaign. Instead, they typically strive to register or mobilize voters. Such groups must register with the Internal Revenue Service and disclose their donors, but there’s no limit to how much money they can receive.

If your organization was created only to further social welfare, defined by the IRS as “the common good and general welfare of people in the community,” you may qualify as a 501(c)(4). However, a 501(c)(4) can also engage in political activities, like electioneering, but only if its primary purpose remains social welfare. These nonprofits can also lobby as much as they like, as long as it’s to help their cause. Donations to a 501(c)(4) are generally not tax-deductible, though there are exceptions for organizations benefiting war veterans or firefighters.

Meanwhile – and stay with me here – a 501(c)(3) organization is another animal. These groups must be formed in the United States and must be “organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes, or to foster national or international amateur sports competition… or for the prevention of cruelty to children or animals.” 501(c)(3) groups can lobby, but not at the expense of their primary goal. However, they cannot be involved in any electioneering or campaign activities. Donations to a 501(c)(3) are generally tax-deductible, unless they’re specifically designated for lobbying.

There are many MANY social entrepreneurs taking root in today’s startup culture. For those out there looking for tax-exempt status and to file as a 501(c)(3) here is our Beginning Guide to Starting a Nonprofit.